在牛市与熊市之间:如何选择你的炒股配资平台

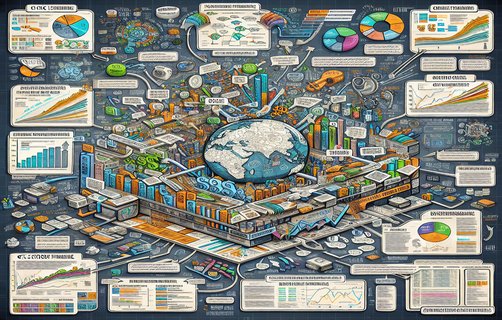

Imagine you’re on a roller coaster – the thrill of the descent and the anticipation of the ascent. This is exactly what trading stocks feels like; every rise and fall is an emotional ride. But what if you had a seatbelt to keep you strapped in during the wild turns? That’s where selecting the right stock trading leverage platform comes into play. As the market fluctuates, choosing the right support can keep your investment strategy not only safe but also potentially profitable.

When we talk about technical analysis, we often envision complex charts and all those seemingly indecipherable indicators. But let’s break it down. Technical analysis isn’t just for quants in glass offices; it can be a powerful tool for everyday investors. By studying price movements and trading volumes, you can forecast potential trends. Did you know that as of 2023, approximately 70% of retail investors use some form of technical indicators to make decisions (source: Investopedia)? Understanding these concepts and being able to read them correctly can give investors an invaluable edge and help them choose the best platforms that align with their strategies.

Now, let's shift gears to high-efficiency market strategies. Many traders swear by the 'buy low, sell high' mantra that sounds so simple but can be elusive in practice. The key lies in timing and research. A site that allows for quick trades, competitive fees, and real-time market data can enhance your responsiveness to market changes. According to a 2022 report by the Financial Times, those who leveraged platforms with swift transaction capabilities increased their profit margins by an estimated 15% over traditional platforms. Imagine what that could mean for your trades!

Evaluating market conditions is akin to checking the weather before a fishing trip. You wouldn’t head out into a storm without preparing, right? A good platform should provide comprehensive market insights and data analysis. Through continuous reassessment of market situations, you can align your investments according to the prevailing trends. As conditions change, your strategy should be adaptable, much like how good sailors navigate unpredictable tides.

But here’s the catch: operating in the stock market isn’t without risks. A balanced risk control strategy is crucial. Instruments like stop-loss orders can be a lifesaver. Utilizing platforms that provide robust risk management tools can keep your capital safeguarded amidst market volatility. Did you know that portfolios with effective risk controls experienced up to 30% less drawdown during market downturns (source: CFA Institute)? This isn’t just theory; it’s proven practice.

Finally, as we navigate this intricate dance of investing, balancing between low buys and high sells is the ultimate goal. The flexibility to act swiftly and utilize margin effectively can be a game changer. Platforms with user-friendly interfaces and advanced trading options not only appeal to seasoned traders but can make the journey enjoyable for novices too. So, as you consider entering this exhilarating world, ask yourself – are you equipped with the right tools?

Let’s hear from you! What’s been your experience with trading platforms? Have you had any successes or challenges that shaped your strategy? Feel free to share your stories!

If you have questions lingering in your mind, let’s tackle them together. How do you decide when to buy or sell? What’s your top tip for newcomers to the stock trading scene? Do you prioritize risk management over potential profits? I’m eager to know your thoughts!

评论

MarketMonk

Very insightful! I never thought about technical analysis in such a simplified way.

投资小白

这篇文章让我对配资平台有了新的认识,感谢分享!

FinanceGuru

I especially liked the emphasis on risk management. It's crucial!

股海独行

文章挺有趣的,想知道更多关于实战的经验!

StockSherpa

Great tips on picking platforms. I’ll definitely be more cautious!